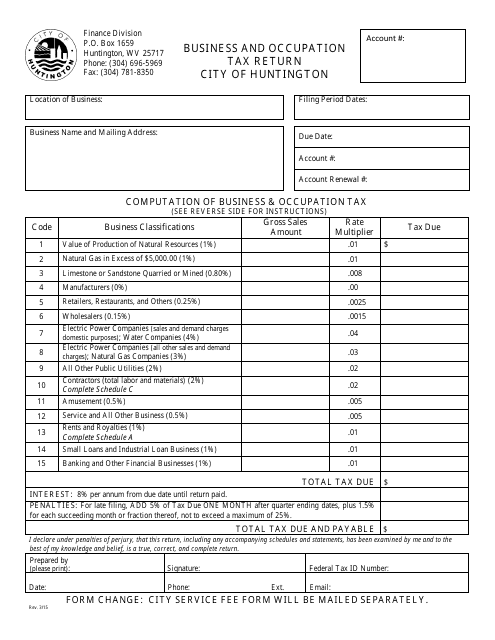

b&o tax form

Filing Frequency and Due Date - BO Tax is due and payable in quarterly or annual installments due on the last day of the month following the reporting period. Download the B O Tax form below.

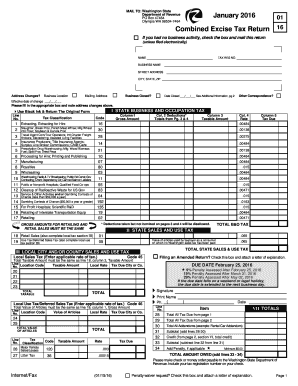

Tax Filing Example Washington Department Of Revenue

Rental Property Registration Form.

. 3 from the 116th Congress. Complete and return the appropriate form below based on your businesss annual total gross revenue. All taxes administered by Bellevue including the Business Occupation Tax and miscellaneous taxes such as utility admission and gambling taxes should be reported on the multi-purpose tax return.

Business Warehouse Floor Space - 4000 taxable square feet. The tax amount is based on the value of the manufactured products or by-products. Business and Occupation Tax.

The tax is due and payable each quarter. Businesses choose which way to submit Tax returns. State Business and Occupation BO Tax Lines 1-6 1.

The state BO tax is a gross receipts tax. Payment to the City of Bellevue and completed returns are to be mailed to. Businesses may be assigned a quarterly or annual reporting period depending on the tax amount or type of tax.

The state BO tax is a gross receipts tax. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. Business And Occupation Tax Return Instructions To avoid a late penalty your Tax Return must be postmarked on or before the due date.

29 of the tax due if not received on or before the last day of the second month following the due date. Box 743041 Los Angeles CA 90074-3041. The income received from sales of tangible personal property or retail services to persons or business entities who will in turn sell them to consumers is taxable under the wholesaling BO tax provided the seller receives from the buyer a completed reseller permit.

Businesses that are required to pay BO tax do not pay the Per Employee Fee. NJ-6 Tom Malinowski NJ-7 Donald M. Tax payments checks only.

Enter the gross income from your business activities under Gross Amount. All businesses are subject to the business and occupation BO tax unless specifically exempted by Auburn City Code ACC. Calculate your total deductions.

Washington unlike many other states does not have an income tax. There is no penalty on late returns with no tax due. It is measured on the value of products gross proceeds of sale or gross income of the business.

Determine your taxes due by multiplying the rate by the taxable income. Business Occupation BO Tax The City assesses a business and occupation BO tax of 01 one tenth of one percent on businesses with gross receipts in excess of 200000. The BO Tax is based upon gross salesservice.

Please include your customer number. Locate the BO Tax classification for your business. General questions or comments.

Determine your Business Classifications and corresponding rates from the tax table. Town Center and Restricted Parking District RPD 2022 Town Center Parking Permit Application. Business Occupation Tax Information.

Contact the City Clerk for any questions or concerns at 253 759-3544 option 1. File and pay BO taxes. Classifications and Minimum Thresholds.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. B. Annual filers will receive their BO Tax Information at the end of the calendar year.

For more information please see the City of Renton Business and Occupation Tax Guide or Renton Municipal Code RMC Chapter 5-25 Business. Wahler about the Elijah E. Annual BO Tax Form.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. What is the Business and Occupation BO tax.

BO TAX CLASSIFICATIONS AND RATES VARY ACCORDING TO THE TYPE OF BUSINESS. Businesses with gross receipts of 15 million or more per year earned within the City of Renton will be required to file and pay BO tax. Sign the form and mail in a check payment for the total taxes due by the Quarterly due date.

Complete the BO Tax From. If this Tax Return is past due the following penalties must be included in your payment - minimum penalty 500 if tax is due. Specific DepartmentDivision questions or comments.

Minimum penalty on all late returns where tax is due is 500. Washingtons BO tax is calculated on gross income from activities. Accounts will be updated within two 2 business days of receipt of payment submission.

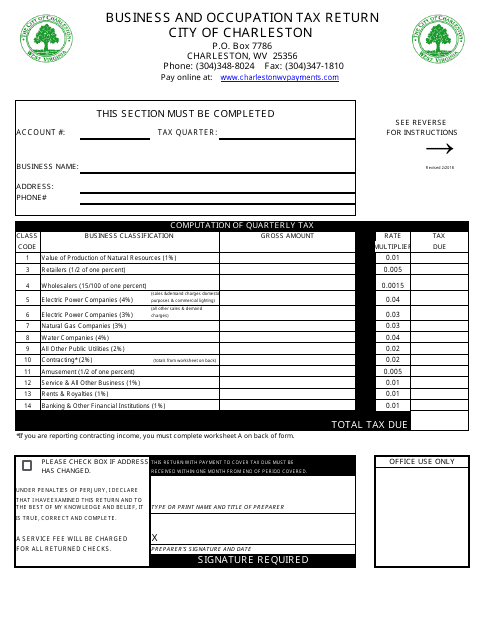

Determine you Charleston BO taxable gross income for each of the classifications and enter it in the appropriate box. See Codified Ordinances of the City of Wheeling Part 7 Chapter 5 Article 787. Washingtons BO tax is calculated on the gross income from activities.

Please write this department if you have questions concerning completing this form or concerning your taxability. Washington unlike many other states does not have an income tax. Forms and additional information are available by calling the City Tax Auditor at 304-487-5027.

Please click highlighted subject to get more detailed contact information ADA Coordinator. This means there are no deductions from the BO. City of Bellevue PO.

Parking Permits on Mercer Island. CONTACT THE CITY OF WHEELING AT 304-234-3653 FOR ADDITIONAL INFORMATION. Representatives Frank Pallone Jr.

Contracting class instructions are listed below 3. However you may be entitled to the. Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for your own records.

Businesses may be assigned a quarterly or annual reporting period depending on the tax amount or type of tax. You may also reach us at 3604425040. Quarterly BO Tax Form.

Cummings Lower Drug Costs Now Act HR. Filing Frequency and Due Date. Address your inquiries to City of Longview B O Tax Department 1525 Broadway PO Box 128 Longview WA 98632.

Tax return enter the date closed and mail to the address listed at the top of your return. It is measured on the value of products gross proceeds of sale or gross income of the business. 2022 North Mercer RPD Permit Application.

BO tax is due for businesses with annual companywide gross receipts over 500000. Annual Business and Occupation Tax Return Form PDF By the Job Business and Occupation Tax Return Form PDF. At the Piscataway Senior Center elderly residents appreciated the opportunity to ask questions of US.

Mail the form and payment to the City of Ruston 5117 N Winnifred Street Ruston WA 98407. NJ-10 alongside Mayor Brian C. No cash may be dropped off at any time in a box located at the front door of Town Hall.

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

What Are The Penalties For Filing Taxes Late Super Lawyers Washington

Writing A Mission Statement For Business Plan In 2021 Writing A Mission Statement Business Planning Mission Statement

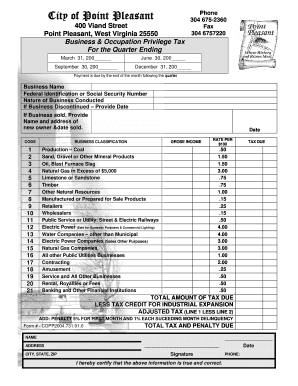

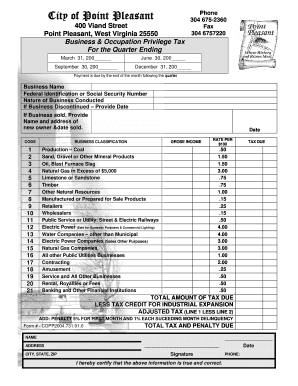

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

City Of Tacoma B O Tax Form Fill Online Printable Fillable Blank Pdffiller

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Alton Baltimore And Ohio Railroad Train

Washington Combined Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Fillable Online City B O Tax Form R Fax Email Print Pdffiller

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

B Amp O Tax Return City Of Bellevue

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Understanding The 4 Most Common Business Occupation B O Tax Classifications In Washington State Irs Seattle Tax Law Firm

City Of Tacoma B O Tax Form Fill Online Printable Fillable Blank Pdffiller

Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller